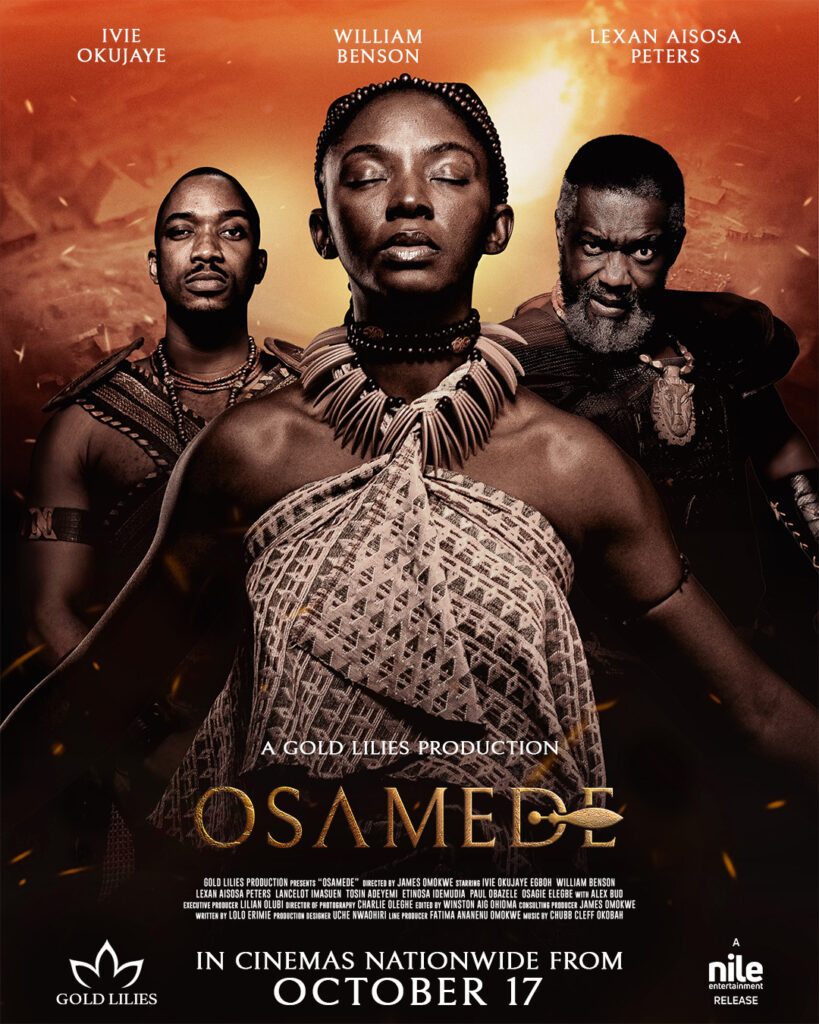

With the upcoming release of ‘Osamede’, a new Benin epic adapted from a hit stage play, Folajimi Alli-Balogun, Assistant Vice President at MBO Capital, explains why the investment firm backed the project, what stands out about its cultural and cinematic value, and the key factors MBO considers before financing films.

The epic arrives in cinemas on October 17 with more than just the weight of its story and performances. Behind the project is the backing of MBO Capital, which is looking to double its ₦2.3 billion bet on Nollywood, one of the few institutional investors with a growing interest in film.

Speaking with Nollywire, Folajimi Alli-Balogun, who last spoke to us at the KAVA launch, revealed how the film entered the firm’s pipeline and why it stood out.

“What we liked about Osamede was that it felt different,” Alli-Balogun said. “We see more Yoruba epics, but this story is rooted in Benin culture. Plus, it was adapted from a stage play that already had a very successful run. That showed us the story resonated with audiences and could transition to film.”

Executive producer Lilian Olubi, who previously spoke to Nollywire about adapting the play into cinema, drove that stage-to-screen transition. Her finance background made it easier to align with MBO Capital’s structures.

Olubi’s background in finance also made the pitch stand out. “She spoke our language,” Alli-Balogun said. “She understood concepts like debt, equity, and structuring, so we were aligned almost from the start.”

What MBO Capital Looks for in Film Projects

Beyond ‘Osamede’, Alli-Balogun explained that three factors determine whether MBO puts money behind a project: the track record of the filmmaking team, the detail of the budget, and the strength of the distribution plan.

- Experienced teams: “We don’t like first-time filmmakers,” he said. “If the executive producer hasn’t done it before, it’s important that the team around them has extensive experience. We want round pegs in round holes, not one person wearing all the hats.”

- Detailed budgets: “The less detailed the budget, the more likely problems will show up during shooting,” Alli-Balogun said. “We like very detailed, line-by-line budgets.”

- Clear distribution strategies: Above all, MBO prioritises distribution. “Producers are becoming more ambitious, and for an investor to commit funds, we need to be convinced there’s a way to recoup. Producers need to show realistic plans for cinemas and streaming platforms like Netflix and Amazon, especially given the peculiarities of the Nigerian market.”

That framework is why ‘Osamede’ caught MBO’s attention. The film, directed by James Omokwe, who marked his return to cinema after directing several hit epic television shows, is based on a successful stage play that ran multiple times and resonated strongly with audiences.

Reception for ‘Osamede’ Ahead of Release

Having seen the film, Alli-Balogun believes audiences will encounter something fresh.

“It’s unlike anything we’ve seen before. The performances are strong, the story has depth, and it’s refreshing to hear a film in the Benin language. Shooting on location in Edo State also gave it stunning visuals,” he said.

That shoot was no small feat. The cast immersed themselves in Benin’s history over 14 days of intense filming, recreating the epic against the backdrop of Edo landscapes.

The film has already stirred anticipation with its trailer, which offers a glimpse into Benin’s past and conversations about how it signals a new wave of diversity in Nollywood storytelling. Industry leaders like Moses Babatope, who expressed confidence in the film’s success, have also underscored its box office potential.

While MBO Capital’s strength remains financial, Alli-Balogun noted the firm continues to provide advisory support to productions it backs. “We can’t advise on creativity, but when it comes to financial models or proposals, we help producers refine them,” he explained.

MBO Capital’s backing of the Ivie Okujaye-led epic signals that the firm is testing the model it believes can make Nollywood more investable. And as the firm deepens its footprint, ‘Osamede’ may be less of an exception than a sign of what’s to come.