Earlier this year, private equity firm MBO Capital disclosed it was looking to double its bet on Nigeria’s creative industry, pushing its investment in the sector from ₦2.3 billion to ₦4.6 billion. The move signalled growing investor confidence in Nollywood’s potential, and for Folajimi Alli-Balogun, Assistant Vice President of Investments at MBO Capital, the ripple effects of that announcement have been both swift and significant.

“The announcement created a lot more attention for us,” Alli-Balogun says. “We’ve been able to find deals in our pipeline that can help us achieve our targets.” Since that investment, the industry has continued to evolve, especially in the way content is distributed. That evolution is where Kava enters the picture.

Launched by Filmhouse Group and Inkblot Studios, Kava is a new global streaming platform built to serve Nollywood and African storytelling. Kava is designed to meet the distribution needs of Nigerian filmmakers and to offer African stories a sustainable, accessible home.

Distribution has long been a pain point in the industry, one that stifles returns and limits reach. For producers and financiers alike, the challenge hasn’t always been making good content; it’s been making sure that content finds its audience. “In conversations with producers, one of the problems they always mention is the distribution issue,” Alli-Balogun says. “And I think Kava will go a long way towards solving that problem.”

For MBO Capital, which continues to back creatives and production companies, platforms like Kava offer new possibilities for downstream revenue. “At least we’re investing [in the ecosystem], but I’m sure that some of the things we invest in will find a home on Kava,” he adds. “So it’s a win-win at the end of the day.”

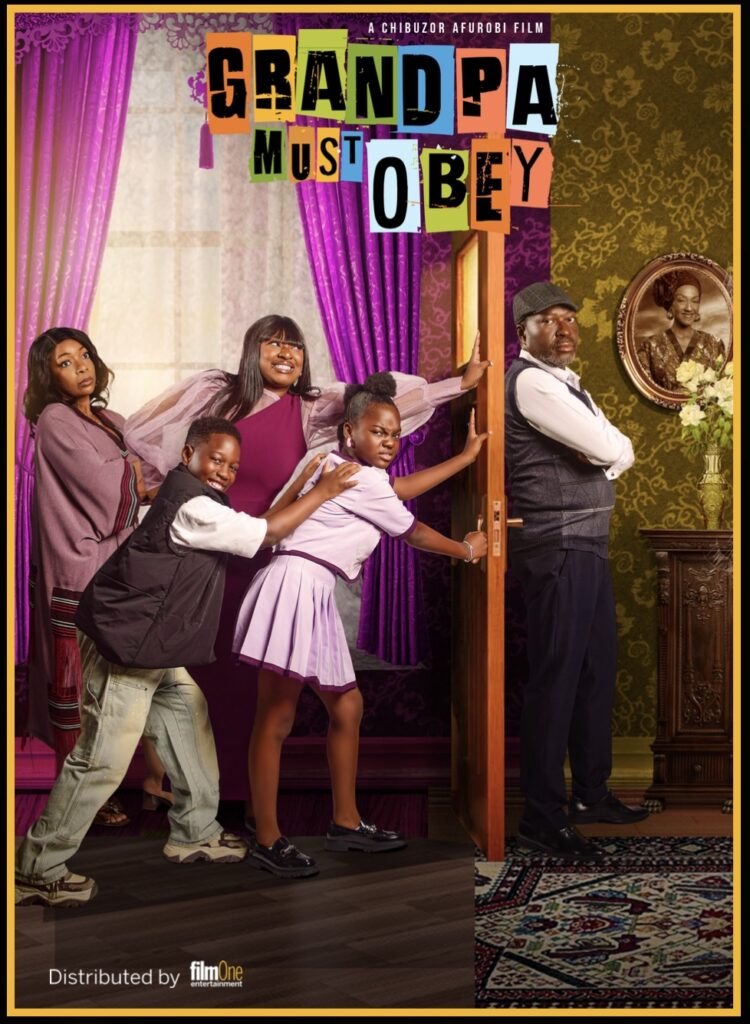

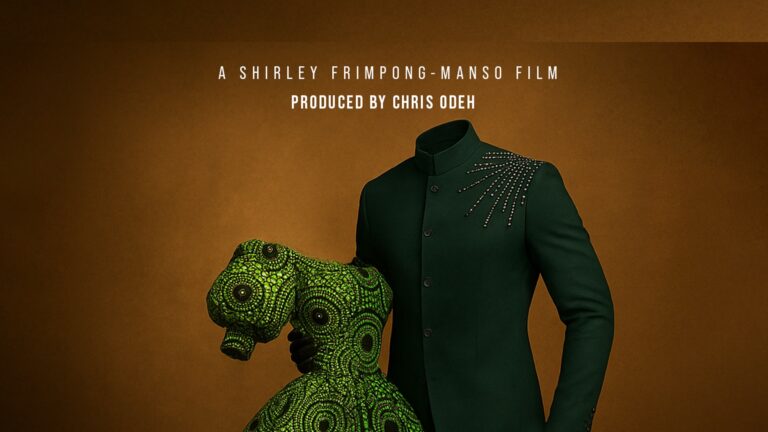

The emergence of Kava also arrives at a time when the quality of Nigerian filmmaking is reaching new heights. For investors evaluating creative projects, there’s a noticeable shift in standards, storytelling, and scale. “What I’ve noticed is that we have a lot of talented filmmakers, and I think the bar is constantly being raised,” says Alli-Balogun. “We can see it even in some of the things that have come out, like ‘To Kill a Monkey,’ but also in some of the other projects we’re working on that I can’t talk about yet. The quality of what is coming out of the industry right now is very high, and I’m really pleased with that.”

However, quality alone isn’t enough. For investments to be viable in the long run, content needs pathways to generate returns. That means monetisation models that go beyond cinema runs and one-off licensing deals. It means platforms that are able to aggregate demand and build communities around the content they host. “As an investor, that’s what you want to see,” Alli-Balogun explains. “We just need to make sure that some of this high-quality content gives investors returns.”

Kava presents itself as part of that solution, bridging the gap between creativity and commerce, visibility and viability. Its success could have broader implications for the entire value chain, attracting new capital, encouraging risk-taking, and ultimately professionalising how Nollywood content is financed and distributed.

For stakeholders like MBO Capital, the hope is that more robust infrastructure will unlock even more potential across the industry. And if platforms like Kava can deliver on their promise, the future of African storytelling might just be bankable.